If your business is struggling with late paying clients or overdue unpaid invoices, your first official port of call in the debt collection process is to issue a debt collection letter – or a letter of demand. This comes into play when the debtor is overdue with payment.

There are however, other steps you should take first in the process to give the client a chance to pay before the letter of demand comes into play. These include reminder invoices and follow up phone calls, which are gentle reminders that the debt is due and they allow you to continue a good working relationship with the debtor.

If these friendly methods fail, a letter of demand is a natural progression.

What are the benefits of a letter of demand?

• You can send it on your own behalf or behalf of your business, however if you want more punch, having a law firm or the backing of a debt collection agency to send it for you can give your debt a higher priority with the debtor.

• It is more cost effective than a heavier duty statutory demand – even if your lawyer does send the letter.

• It can be sent to individual debtors as well as companies.

• You don’t need Court approval or process.

• You can send it whenever you wish and can be sent by post or email – or both.

You do need to remember that a letter of demand has certain rules about what it needs to contain – and what it cannot mention.

Checklist for inclusion in a letter of demand

What you cannot do in a letter of demand

× Threaten violence or harm

× Use obscene, swear or derogatory language

× Lie about the amount you are owed

× Misrepresentation that you are a lawyer or debt collection agency

× Take or threaten to take the goods or your property

× Lie about taking steps that you haven’t done or imply that you will take steps that you don’t intend to e.g. filing court proceedings for the debt

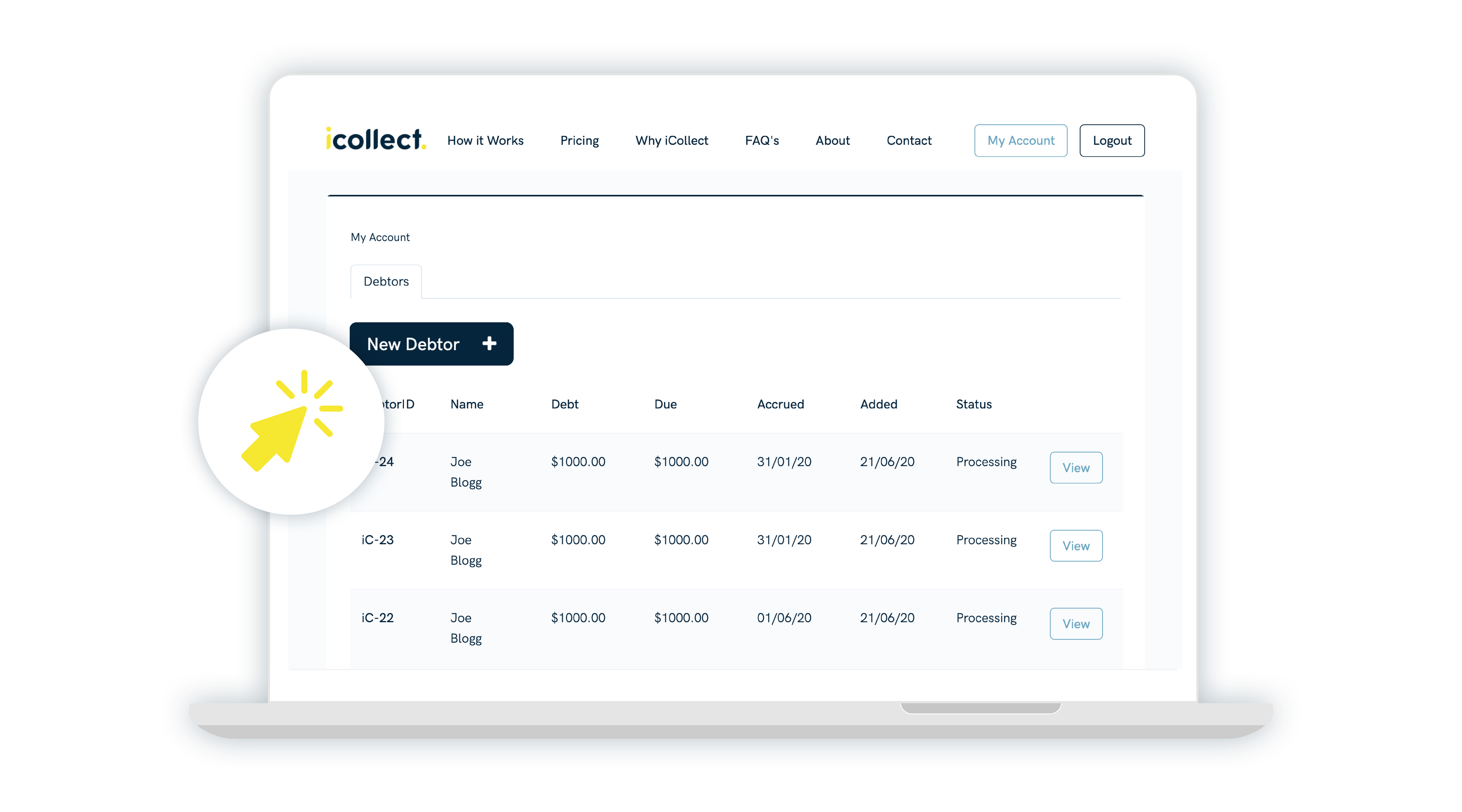

While you can certainly write these letters yourself or get your lawyer to action this, a proven effective method of getting your debts paid is to use DiY debt collection software to generate these letters, backed by the power of a debt collection agency’s letterhead.

iCollect’s letters to debtors tick all the boxes above, providing clear and concise ways for debtors to pay through a variety of methods, while giving you the credibility of a third party and multiple options for communicating with debtors.