With the end of the NZ tax year just behind us, it’s timely to consider the relationship between taxes and debt collection. Around half of everyone expecting to get a tax refund will use the money to pay off debt, making tax season the most productive time of year for many debt collection agencies, and that includes debt recovery software.

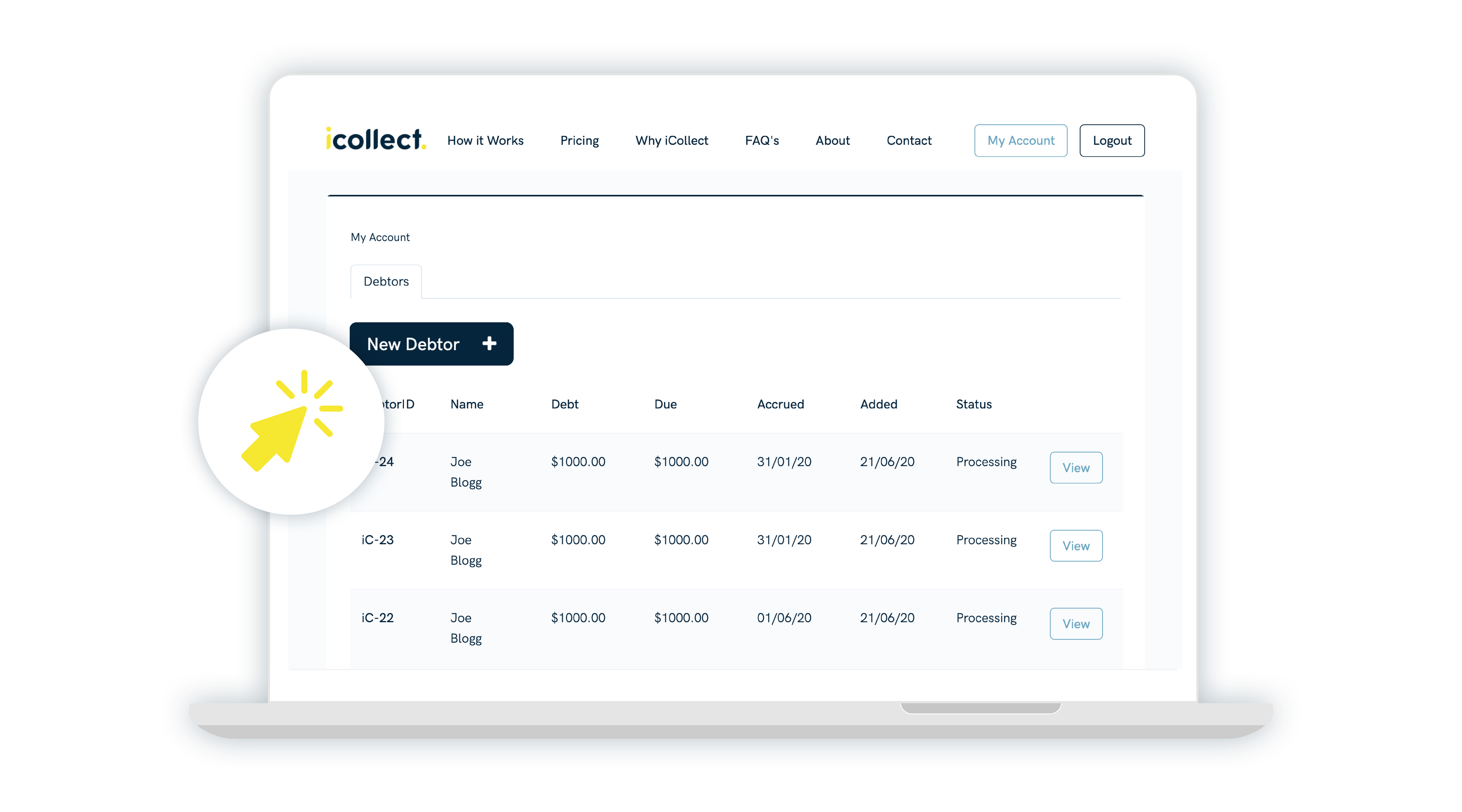

At iCollect, our debt collection software is designed to help you collect debt quickly without hurting your relationship with your customers. One of the best ways to do this is to strike when the iron is hot and maximise profitable periods when people are most willing and able to repay their debts. Here are three effective ways to maximise this productive tax season and get money owed to you back.

Encourage One-off Payments

After getting a tax return, customers are more likely to repay a debt in a single, one-off payment than at any other time of the year. This makes sense of course: for most people, a tax refund is the only time in the year where an unaccounted for large sum of money will be injected into their bank account. Keep this in mind, and consider offering incentives to encourage one-off payments of debt.

Start Early

Get onto debt collection as early as possible in the new financial year, before people start committing their tax return to other sources. You want them to pay off your debt while they’re still using their logical brain. Wait too long and that flash new lounge suite might seem more appealing than paying down debt. With the financial year ending in April, people are only just starting to sort out their financial affairs, so now is the perfect time to act.

Keep that Customer Service Up

The beauty of iCollect’s debt recovery software is that it fosters healthy relationships between you and your customers, even those in debt. Remember this, and stick to your polite, friendly business persona while trying to collect debt during this season – you’ll keep your customer and are likely to see a healthy amount of incoming cash.